Danny Stone, head of data, provides an update on online betting and the effect sporting cancellations from the global coronavirus pandemic are having on gambling companies.

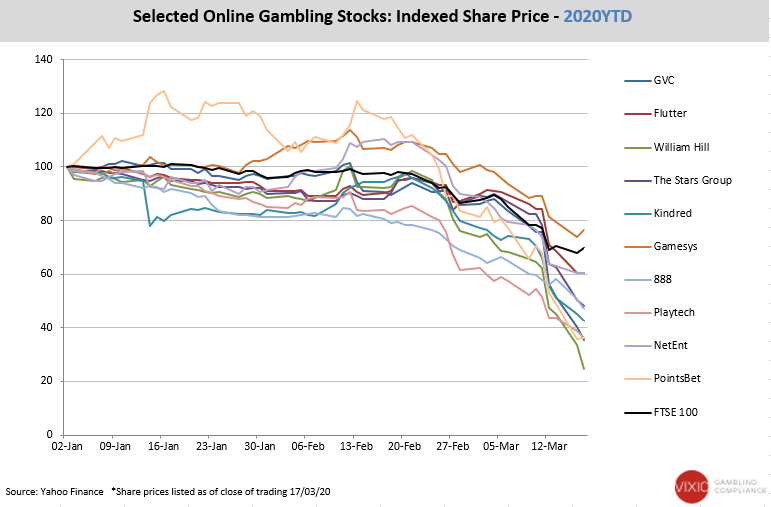

The global coronavirus pandemic has been the primary driver of massive, broad-based share price declines across listed, betting-exposed gambling operators over the course of this month. While cancellations have so far been broad-based and global in nature, bookmakers across Europe will be stung in particular by the on-going absence of meaningful football and tennis fixtures, with the recent cancellation of the March Madness college basketball tournament further weighing on operators in the nascent U.S. sports betting space.

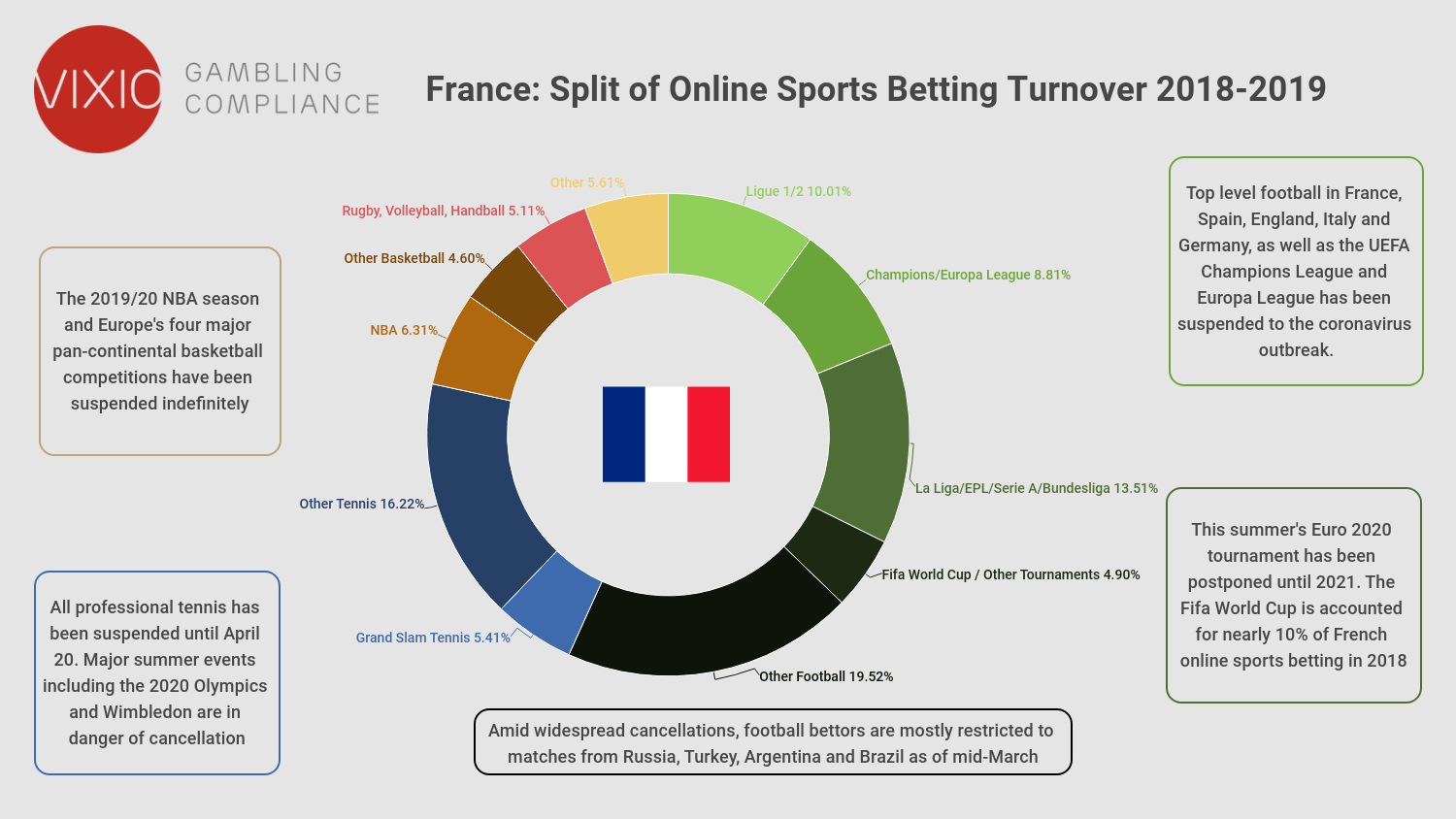

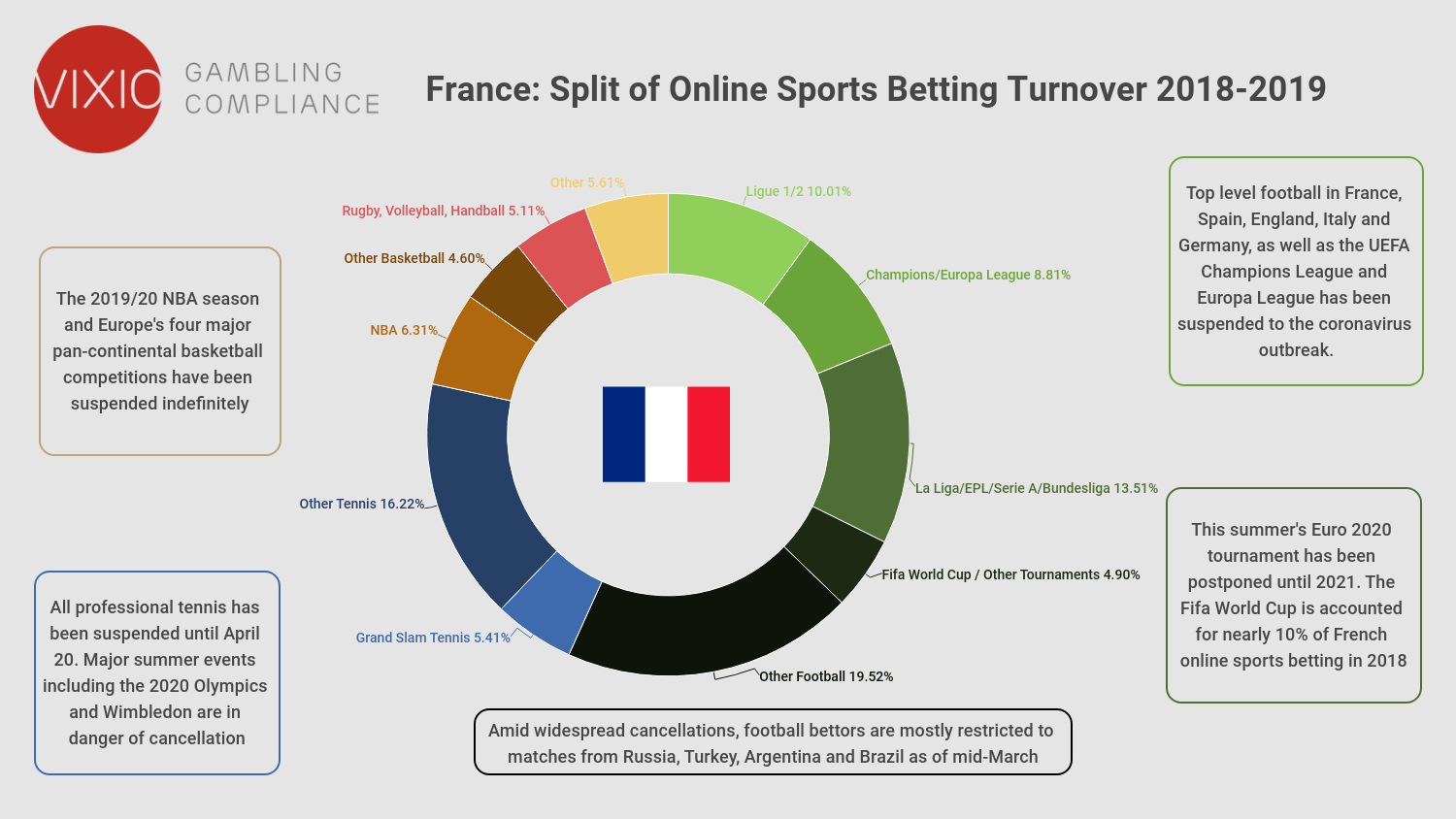

Detailed quarterly market reports filed by French online gambling regulator ARJEL provide a unique insight into the relative importance of sporting competitions for operators. The below chart illustrates the breakdown of French online sports betting turnover over the last two years, where football, tennis, and basketball accounted for 56.8 percent, 21.7 percent and 10.9 percent of amounts wagered respectively.

The heavy concentration of betting activity within these three core sports leaves bookmakers massively exposed to lost revenue arising from the decisions of a relatively small number of leagues, associations, and sporting bodies.

The effectively indefinite suspension of football across Europe’s major leagues in recent weeks was followed by the announcement on Tuesday that this summer’s Euro 2020 tournament will be postponed for a year in order to maximise the chance of 2019/20 club competitions reaching some kind of conclusion.

As it is licensed separately by the French regulator, the sport-by-sport breakdowns provided by ARJEL do not include horse racing, another traditional betting cornerstone that has now succumbed to coronavirus cancellations.

With last week’s Cheltenham Festival having controversially forged ahead and reached its conclusion in front of mass crowds, the British Horse Racing Authority on Tuesday followed the cancellation of next month’s Grand National with the suspension of all horse racing events in the UK until the end of April.

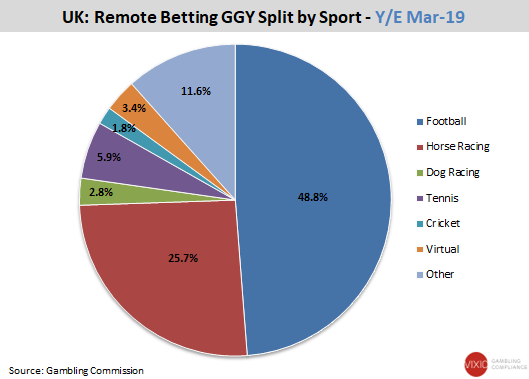

Though horse racing plays a more significant role in the UK’s increasingly beleaguered retail betting sector, the activity also accounted for over a quarter of UK remote betting GGY of £2.03bn in the year to March 2019, with key festivals at Cheltenham, Aintree and Ascot playing a major role in customer acquisition efforts between March and June each year.

Virtual betting, early versions of which are thought to have been developed in response to the UK’s foot and mouth disease outbreak back in 2001, remains untouched by the current crisis due to its reliance on random-number-generated outcomes rather than real sporting events.

Betting on virtual racing, football and other sports drove £69m or 3.4 percent of total UK remote betting GGY in the year to March 2019 and will likely prove to be of far greater importance for both operators and suppliers in the fallow months to come.

U.S. sports betting, which has progressively developed into a holy grail for European

operators struggling with regulatory and operational headwinds in maturing core

markets, will also face its biggest speed bump to date in the coming months.

Multi-channel specialist GoldBet, which was acquired by domestic retail giant Gamenet in October 2018, is the sixth-largest online betting brand in Italy but a clear market leader in virtual betting specifically.

Data collated by newswire Agipronews shows that GoldBet held a 41.4 percent share of the near €30m virtual betting segment in 2019, ahead of GVC’s Eurobet with 16.4 percent, Sisal with 11.1 percent, Playtech-owned Snaitech with 9.8 percent and Lottomatica with 8.8 percent.

U.S. sports betting, which has progressively developed into a holy grail for European operators struggling with regulatory and operational headwinds in maturing core markets, will also face its biggest speed bump to date in the coming months.

Last week’s cancellation of the 2020 NCAA March Madness tournament will deprive U.S.-facing sportsbooks of a competition that has developed into a betting bonanza for sportsbooks in Nevada and, since summer 2018, emerging regulated state markets across the country. Analysis carried out by VIXIO GamblingCompliance indicates that online operators in New Jersey, in particular, will also be significantly exposed to cancellations of sports events outside U.S. borders.

To find opportunity and stay ahead of a volatile and fast-evolving market, subscribe to VIXIO GamblingCompliance. We will ensure you get the insight and intelligence you need to make informed, strategic decisions