- Gambling shares perform worse than sinking market

- Sports cancellations multiply

- Crossover to casino questioned

Gambling stocks were pounded worse than a plummeting market on Thursday, with one gambling consultant warning that the possible cancellation of the Euro 2020 football championship could lead to “haemorrhaging” of players.

A stunning array of sporting events have been cancelled in the past few days, leading investors to expect the worst.

All sports in Italy have been suspended, as has Spain’s La Liga, the Danish Football Association and Euroleague basketball games, and the English Premier League, Six Nations Rugby and Champions League tournaments may not finish.

The season-opening Formula 1 Grand Prix in Australia has also been called off and all professional tennis events are cancelled until at least April 20.

In North America, the National Basketball Association, National Hockey League and Major League Soccer have suspended games.

Last night also saw confirmation that one of the biggest US betting events of the year, the March Madness college basketball tournament, is cancelled for 2020.

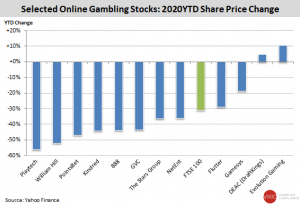

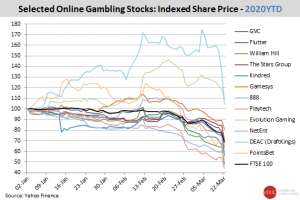

The parade of cancellations pushed William Hill down 24 percent and GVC down 20 percent. Flutter Entertainment dropped 15.5 percent and Playtech were off 15 percent.

Only 888 Holdings, down 3 percent, bettered the 9.4 percent drop of the FTSE 250 Index.

In Stockholm, Kindred Group fell 15.5 percent, while Betsson declined 9.8 percent. On the US NASDAQ market, recently listed DraftKings dropped 23 percent.

Investors apparently did not believe the most optimistic scenario, which has online casino operators benefiting from players quarantined or working from home, bored and unable to visit their local bookmaker shop for entertainment.

For European bookmakers, the Euro 2020 football championships are key — crucial for generating leads and for luring sports bettors to more lucrative online games like slots or roulette.

“The Euros being cancelled would mean haemorrhaging active and reactivating players across what should be a summer of soccer betting and allied cross sell,” said Ismail Vali, with iGaming Leaders consulting firm.

Cancellation of the Euros would hurt sportsbooks all across Europe, said Lee Richardson, chief executive of Gaming Economics online gambling advisory firm.

“There really is no substitute product available, and you could say the same thing about the Olympics scheduled for August. Although of much lesser betting interest, it would still represent loss of irreplaceable turnover in 2020,” he said.

Software giant Playtech has already taken a hit from shutdown of its Snaitech retail shops in Italy and other B2B suppliers might take a hit too, as many commercial deals rely on turnover and revenue sharing, Richardson said.

Winners as coronavirus problems escalate are hard to see, but “self isolation” and the shutdown of retail could boost some online activity, but “there’s always a chance that’s something of a zero-sum game”, he said.

Some online companies could benefit from bored customers sitting at home, whether pretending to work or not, said Vincent van ‘t Riet, a Dutch gambling consultant.

But cancellation of the Euros would be “huge,” and “players will stay away from betting sites altogether if there is lack of sports-betting product”, he said.

Vali said he was “not totally pessimistic”, even if the Euros are cancelled.

Past crises, like a slump after 9-11 or the UK-based foot and mouth disease, which suspended horseracing for a time, “helped focus innovation upon new promos to divert attention and encourage changed activity”, he said.

UK bookmaker Howard Chisholm said he has not seen a noticeable coronavirus effect on retail trade so far.

Chisholm was critical of the UK government for not forcing the popular racing event, the Cheltenham Festival, to operate behind closed doors this week.

“Certainly the TV pictures appear to show that ‘racing folk’ are taking very few precautions against the spread of the virus,” he said.

Retail bookmakers’ concern is that the audience is largely punters who “will be back in betting shops throughout the UK and Ireland on Saturday potentially carrying the virus”, Chisholm said.

One big fear is an Italy-style shutdown of businesses that would cripple local bookmakers, he said.

“Following the financial shock of the introduction of the £2 maximum gaming machine stake last year I think anything more than a two-week closure would have a disastrous effect on the industry,” Chisholm said.